If you’ve been a first time home buyer, you quickly learned that you have to purchase homeowner’s insurance on your future house in order to get to closing. But did you know that there are times when you should never switch homeowner’s insurance?

Even if you can afford to buy your house outright, (yay for you!) it’s still a good idea to carry homeowner’s insurance. In the off chance that something happens to make your home unlivable, you would (likely) be covered.

However, there are serious quirks with homeowner’s insurance, that most people either don’t know or don’t tell you.

I want to share a serious one with you.

Our Experience Switching Homeowner’s Insurance

In early June 2020, with the entire world going bat crap crazy around us (I’m sure you weren’t excluded), we got the new premium for our car insurance. It just kept actively creeping higher.

So we shopped around, decided to go with Geico.

The agent recommended to Ryan that we switch homeowner’s insurance also. We’ve done that in the past and it usually adds a small discount.

Hubby explained to the agent that we were in the beginning stages of a 2.5 car garage addition. He explained we were doing it ourselves and didn’t have a timeline for completion. However, we were doing it as quickly as possible.

The agent assured Ryan it would be no problem at all.

So we switched homeowner’s insurance also to Geico and kept on with our busy Fixer life.

The agent lied.

July 2, 2020, not one month into our new insurance policy, we get a letter in the mail. In no uncertain terms, it stated that the side entry needed to have stairs and the garage addition had to be completed with pictures for proof by 8/4/20 or they would be cancelling our policy.

Ryan called them. Explained that he already explained this to the agent who convinced us to switch.

They wouldn’t budge.

It had to be done by 8/4 or they would cancel the insurance. Apparently we had till 9/4/20 before it was actually uninsured, but we knew our banks would be freaking out before then for sure.

The Mistakes We Made By Switching Homeowner’s Insurance

There were several big ones.

#1 – We trusted the agent

I hate to say that, but never trust the agent. They have a commission and other rewards (like all-expense-paid vacations) hanging over your head. In other words, you are a number to add to the tally. Some have consciences, but remember they need to feed their families too.

If you have a question, search it out online or speak to other homeowner’s in your circle before confirming anything with an agent. Never discount the advice Mom and Dad or the older adults in your life could offer either.

And always, ALWAYS document the agent’s full name and the date and time of day you speak with them, so you have the info if need be.

#2 – We weren’t focused

We had so many things going on.

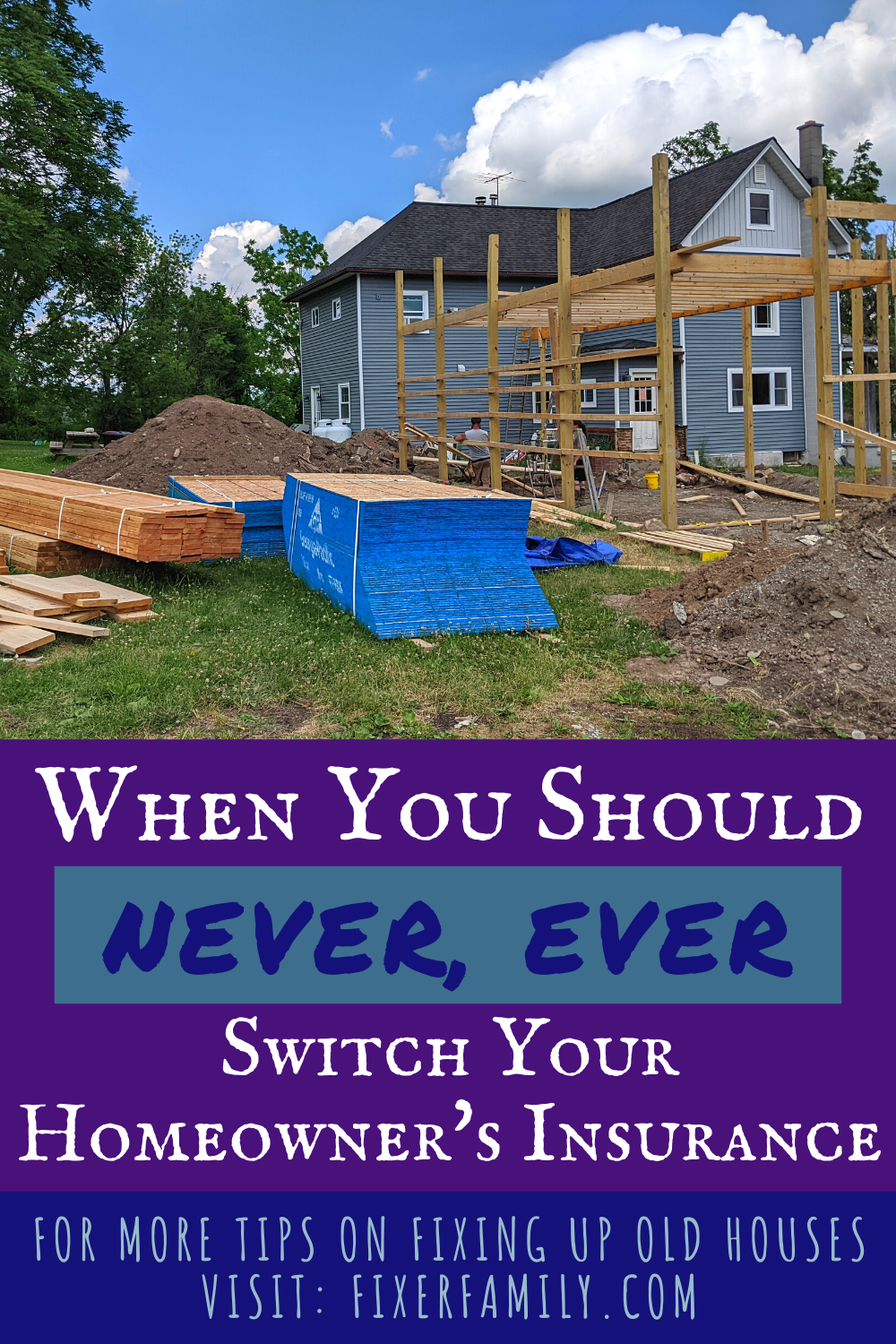

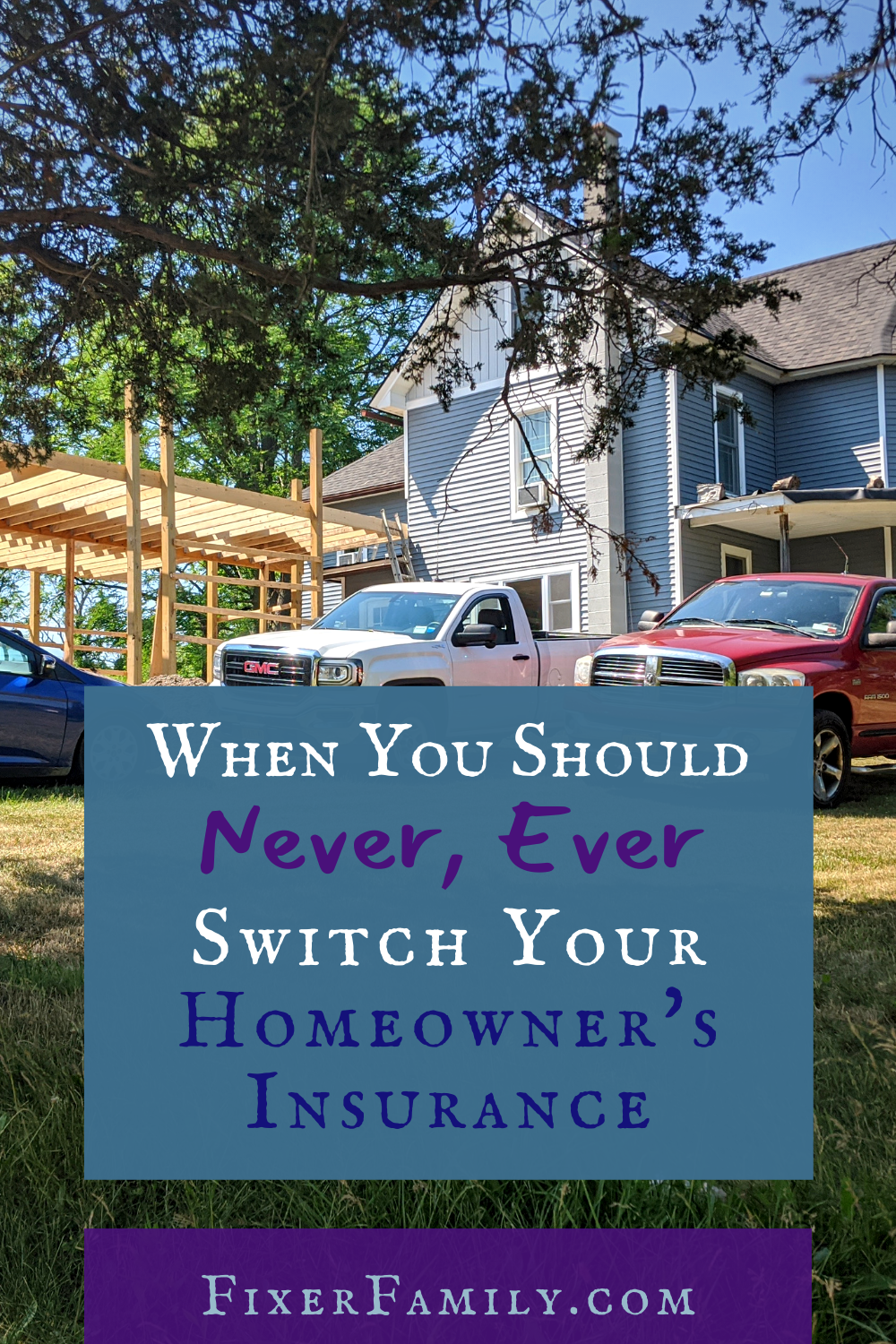

The garage was excavated, 14 – twenty foot posts were cemented into the ground and joists were going up for the second floor – entirely by us with help from a friend.

I had weekly chiropractic appointments from a bad car accident years ago, two littles to care for, a new dog who constantly wanted to mark his territory and poop in the house on the new carpet.

We had a huge, thriving, raised bed garden to tend and 10 laying chickens to care for daily.

Add to that, I was still trying to follow an altered AIP diet for health issues (which is a full-time job in itself), and trying to feed and coordinate the friends/family who were helping my husband who was building the garage around his full-time job.

Car insurance and homeowner’s insurance were the next to last things on our mind. So we were easy to convince. Or swindle.

The takeaway: Never go into buying insurance unfocused.

#3 – We were naive

After buying three different houses, you’d think we would be well versed in what happens with insurance.

For some reason, those things hadn’t stuck. We’d been renovating the last 8 years of our lives, almost nonstop and dealing with homeowner’s insurance was such a tiny fraction of that time.

ALSO – we didn’t have an ounce of trouble initially insuring any one of the three fixers we’ve bought.

The third fixer needed extensive outdoor work. The roof needed almost immediate replacement, the siding was cracked and falling off in numerous places, there was a major yellow jacket infestation in numerous areas of the house, and the front porch didn’t even have a floor.

We had no problem whatsoever insuring it for the full value of a 2800 square foot home.

After the improvements we made, which were:

- a brand new lifetime-warranty roof

- new siding

- cement porch floor

- windows throughout

- some landscaping

We were extremely naive that they would have issues with an in-progress new-build project that we had permits for AND informed them about beforehand.

Some Important Insights on Insurance

- When you sign up for homeowner’s insurance, they will in most cases approve it with no apparent conditions

- They might send an independent adjuster out to the property address to do a ‘review’ without informing you or letting you know they are there

- If it doesn’t meet their unnamed criteria, they will send you a list of required repairs or changes they want made with a threat to cancel your policy

In our case, we had one month to finish a 2.5 car garage with a full upstairs, that was in the very beginning stages.

THIS is literally where we were:

(Oh, and “yard has debris in need of removal”. No. Duh.)

Never, ever switch homeowner’s insurance if you’re at the beginning or in the middle of a project like this.

We had ONE MONTH to finish it. If we were able to pay a contractor 50+k to finish the job and formally give them a completion date, they would have (supposedly) accepted that.

However, as every other Fixer knows, that’s not why we fix.

Some of the reasons we fix things ourselves are:

- We don’t have time or energy to vet a contractor (we’ve had numerous BAD experiences with vetted hired help)

- We want complete control over the project, and to see things in every stage

- Most times the supplies are cheaper for US to get than to get through a contractor – by a third or more

- We don’t want the added equity of the improvements spent on someone else when we could do the work just as well or better

The whole point of fixing is to do the hard work yourself, so you can get ahead and build equity into your home.

What to Remember About Switching Homeowner’s Insurance

Basically, don’t ever switch homeowner’s insurance when you’re in the middle of a project.

Definitely check the terms in your policy on if you need to notify your current company when you’re working or having work done to your house.

Ultimately for us, we had to spend tons more time online and on the phone with other companies until we found one who actually understood where our situation was and gave us a better rate at the same time.

But never, ever, ever switch to a different company when you’re in the middle of a project, no matter what the agent says.

It could save you serious headaches, or a nightmare situation like ours where the threat of cancellation is there with unrealistic stipulations to get it back.